nebraska lottery tax calculator

69 Nebraska state tax on lottery winnings in the USA. Current Mega Millions Jackpot Friday Oct 07 2022 410000000 Federal Tax.

Michigan Lottery Tax Calculator Comparethelotto Com

Texas has chosen to add 0 additional taxes to lottery winnings.

. Its a progressive system which means that taxpayers who earn more pay higher taxes. Two 65000 Pick 5 jackpot winning tickets were sold at. Add the total tax rate of.

Nebraskas state income tax system is similar to the federal system. A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money. To use our Powerball calculator just type in the advertised jackpot amount and select your state and the calculator will do the rest.

You must report that money as income on your 2018 tax return. A lottery payout calculator can help you find the lump sum or annuity payout of your lottery winnings based on the advertised jackpot amount multiplier and the total number. You may then be eligible for a refund or have to pay more.

Kum Go 371 13149 Fort St Omaha. Nebraska Department of Revenue. 5 Nevada state tax on lottery winnings in the USA.

Probably much less than you think. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot. How to Use the Lottery Tax Calculator for Lump-Sum Payments.

The state has the choice to impose additional taxes for example if you win the lottery in New York you pay an additional. Use ADPs Nebraska Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Add the total value of the prize and keep the length as 1 as in one single payment.

Caseys 2716 1610 Colfax St Schuyler. There are four tax brackets in. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot the statecity you live in the state.

For postsecondary education private career schools nebraska college fund school closings state colleges university of nebraska. Nebraska lottery tax calculator. You are able to use our nebraska state tax calculator to calculate your total tax costs in the tax year 202223.

Lucky for Life NE. Just enter the wages tax withholdings and other information required. 25 State Tax.

The calculator will display the taxes owed and the net jackpot what you take home after taxes. After you are done check out our guide on the best lottery. All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding.

This tool helps you calculate the exact amount. 800-742-7474 NE and IA. This tool helps you calculate the exact amount.

Two 5000 MyDaY winning tickets were sold at.

Mega Millions Payout Calculator After Tax July 26 Heavy Com

Best Online Lottery Games 2022 How To Play The Lottery Online

Best Online Lottery Games 2022 How To Play The Lottery Online

What To Do If You Win The Lottery

Lottery Calculator The Turbotax Blog

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Calculating Taxes On Gambling Winnings In Michigan

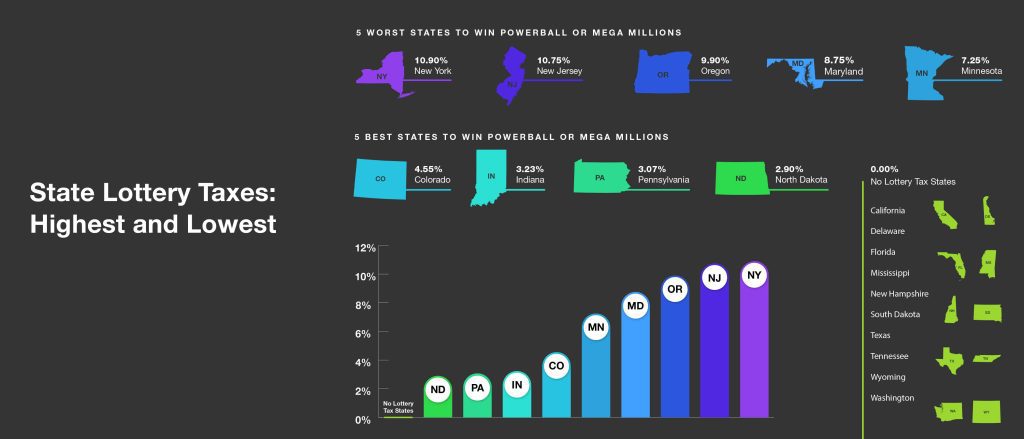

Top 5 Best And Worst States To Win The Lottery

What Percentage Of Lottery Winnings Would Be Withheld In Your State

Do You Pay Taxes On Powerball Jackpots H R Block

Ct 1040 Instructions 2011 Connecticut Resident Income Tax Ct Gov

Usa Lottery Tax Calculators Comparethelotto Com

Free Gambling Winnings Tax Calculator All 50 Us States

Lottery Calculators Calculate Taxes Payouts Winning Odds

Mega Millions Payout Calculator

Power Ball Odds Of Winning Are 1 In Over 200 Million How Does The Lottery Calculate The Odds Of Winning Quora

Do I Have To Pay State Taxes On Lottery Winnings If I Don T Live In That State

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Mega Millions 1 1 Billion Jackpot Here S How Much You Would Take Home After Federal And State Taxes Back Page Unionleader Com